Sengkang General Hospital will NEVER ask you to transfer money over a call. If in doubt, call the 24/7 ScamShield helpline at 1799, or visit the ScamShield website at www.scamshield.gov.sg

Integrated Shield Plan

They comprise two components:

1. MediShield Life component run by the Central Provident Board (CPF) Board.

2. Additional private insurance coverage component run by the insurance company, typically to cover A/B1-type wards in public hospitals or private hospitals.

If you have an Integrated Shield plan, you are already covered by MediShield Life.

MediShield Life is included in all Integrated Shield Plans. MediShield Life will cover you for life, including your pre-existing conditions. This is the case even if your pre-existing conditions are not covered under the additional portion of your Integrated Shield plan from your private insurer.

The company you have taken the plan out with acts as your single point of contact. They will act on the CPF Board’s behalf for premium collection and claims disbursement for the MediShield Life component of your Integrated Shield plan.

These are the Integrated Shield Plans (IPs) available on the market as of 1 April 2023.

We seek your understanding that these integrated shield plans are not managed by Sengkang General Hospital and thus it might be best to go to these insurers directly for any information relating to their IPs.

Common reasons why insurers may reject or not pay for claims made

Having an insurance policy does not always mean that you will receive a payout for your claim. For more information regarding your claim and insurance coverage, please check with your insurer.

Common reasons for claims rejection or no payouts

• Claim amount is below the deductible

• Medical condition is excluded from the policy

• General exclusions, such as pregnancy and maternity expenses

Source:

CPF website (CPFB | Read this before buying an Integrated Shield Plan (IP))

MOH website (MOH | About Integrated Shield Plans)

MOH website (MOH | Comparison of Integrated Shield Plans)

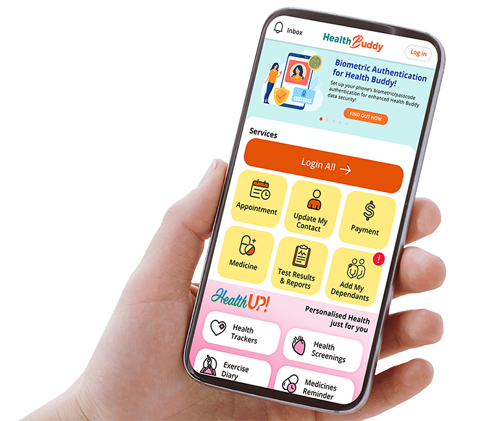

Stay Healthy With

© 2025 SingHealth Group. All Rights Reserved.